by Kaitlyn Ranze |

Last year nearly 4 in 10 people made a financial resolution. According to a report from the University of Scranton’s “Journal of Clinical Psychology,” eighty percent of those fail.

We’re not telling you to make a resolution.

We’re here to increase your odds of succeeding year-round. Here are the 6 simple steps to increase your financial security and become more financially resilient in the New Year.

(Or check out the FREE downloadable guide here.)

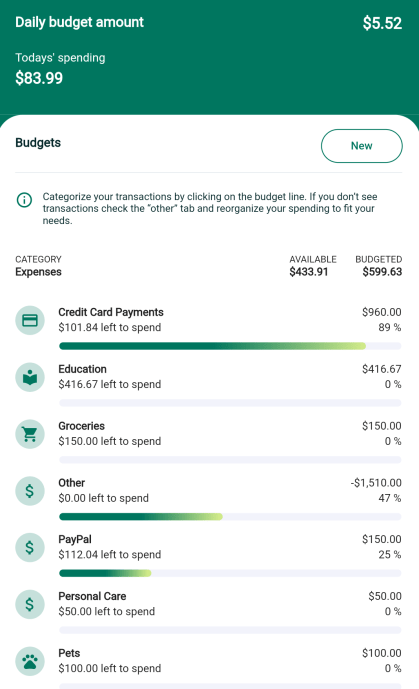

Step 1: Create a budget

In the words of Nav.It founder, Erin Papworth, “If you’re truly embracing a positive money mindset, the b word doesn’t send you hiding under your covers after an expensive night out. In fact, your secret weapon to financial freedom is knowing where your money is going, and how much is left over for some fun along the way.”

Budgeting will have you feeling good like you should.

It begins with tracking your income.

Income includes wages, child-support, alimony, side-hustles

Then, determine how much you’re spending (your expenses) from month to month or paycheck to paycheck.

Expenses include things like housing, transportation, food, loans, childcare, taxes, and entertainment.

Subtract expenses from income.

(Not into writing it out or highlighting endless statements? Me neither. Check out how you can automate and customize your budget inside the nav.it app.)

Based on what’s left, you’ll need to create a plan.

Scenario One: Your expenses are higher than your income

You have a couple of options to manage your money.

Earn more: take on a second job or start a side hustle from a hobby. You could tutor, become a virtual assistant, or start an online store. This is an opportunity for you to challenge yourself and try something new.

or

Spend less: Make a list of essential expenses. Housing, transportation, utilities, budgeted food, and kids all require a chunk of your income. If you’re reducing spending, identify the non-essential items you can stop first.

Avoid feeling deprived by getting creative and challenging yourself to do what you can with what you have.

Increasing your financial resiliency starts with a budget that strengthens your money management game.

Scenario Two: You break even or have a little extra.

You have a good idea how much you earn and don’t go over. Well done! But how can you increase your financial resilience? Half of U.S. consumers believing they should have $10,000 or more in emergency savings, but only have$3k it less in their accounts.

How can we further increase financial resiliency? Read on.

Step 2: Manage your debt

If you haven’t already figured it out through your budget, it’s important to know how much you owe. Credit cards, personal loans, home equity lines of credit, mortgages? The right plan can help you manage your debts, save you money, and increase your financial resiliency.

We’ve done some research into the best methods for paying down debt so you don’t have to.

Find a Payment Strategy

Pay More Than Your Minimum

Your creditor gives you a monthly minimum payment (for credit cards around 2-3 percent of your overall balance). However, these banks benefit from the interest they charge you each period. The longer it takes you to pay, the more money goes into their pocket and out of yours.

Bottom line: PAY MORE THAN THE MINIMUM.

Psst…If you haven’t already tried them, head to your Me.Inc page on the app to explore Nav.it’s Debt Repayment and APR Calculators!

What’s the best strategy for debt repayment?

The surplus of money you have from managing your income and expenses well could mean you could throw it at your debt repayments.

Debt Snowball

With this debt repayment strategy, you pay off the smallest debt, then roll that payment into your next smallest loan. With each debt that’s paid off, your repayment increases in size, like a snowball.

Debt Avalanche

The avalanche method has you pay off the debt with the HIGHEST interest first. It’s cheaper than the Snowball Method as the highest payment also likely means it’s the card with the highest interest. So if you get rid of it first, you’ll be paying down smaller amounts faster.

Automate your payments

Studies show that chronic debt impairs mental functioning and decision-making, contributing to costly mental accounts that consume cognitive bandwidth. Manage your debt and your burdens through automation.

You’ll avoid racking up additional costs in late fees and alleviate the cognitive burden of remembering to make a payment.

Debt Consolidation

Speaking of being spread too thin, did you know you can consolidate your debt payments into one account? This is helpful if you’re paying off debt from more than one account. (Been there, hate that.)

Find a zero percent balance transfer credit card

It sounds crazy to open up another credit card account when you’re working to pay off your debt, but if you find a card with a long zero percent introductory period (15-18 months) and you transfer all of your outstanding credit card debt to that one account, you’ll have one payment each month without interest. (Miracles do happen.)

Find a fixed rate personal loan

Consider a FIXED RATE debt consolidation loan to pay off your debt. Why consider another thing to pay off? Well, personal loans tend to offer lower interest rates than credit cards.

Negotiate

You can refinance your mortgage and student loans for better terms, but adjusting terms for a credit card requires a little negotiation.

How to negotiate credit card debt

First, get prepared: Confirm how much you owe and your interest rates.

Second, review your options: Decide if a lump-sum settlement, workout agreement, or hardship agreement makes the most sense for your circumstances.

Lump-Sum Settlement – With this negotiation, you offer to settle your outstanding debt in one big payment, typically for less than your balance. One downside of a lump-sum settlement – a notation could be added to your credit report that shows the account was “settled for less than the full balance.” This could be bad for your credit score.

Workout Agreement – With this negotiation, your creditor will lower your interest rate or temporarily waive interest altogether. They may also take other steps to help you manage your debt including waiving past late fees or reducing minimum payments. Unfortunately, the creditor may stipulate the closure of your account, reducing your total available credit, and dropping your credit score.

Forbearance – With this agreement, your card issuer may agree to lower your interest rate and minimum payments or suspend late fees. You might even be able to skip a few payments while you work to rebound from the financial setback. Alas, this also jeopardizes both your credit history and scores.

Finally, make the phone call and ask.

Most customer service representatives won’t have the authority to approve your requests so ask for debt settlement, loss mitigation, or hardship departments. Once you’re connected with someone who has the ability to negotiate on behalf of the creditor, explain your situation and make your offer. If you’re considering bankruptcy or a third party to manage the debt, let them know, but be prepared for the creditor to freeze the account.

Don’t forget to take detailed notes and follow up. If they say no the first time, follow-up and ask again, and again, and again. Persistence is resiliency’s best friend.

Get the agreement in writing.

Avoid crisis mode and withstand life events that impact your income by paying down debt in advance.

Step 3: Prepare for the Unexpected

Increase your financial resilience by asking yourself four questions.

Do you have an emergency fund?

A global pandemic -or any other health emergency- is exactly why it’s important to prioritize emergency savings. This fund increases your resilience through unexpected events, like furloughs or travel disruptions. It also provides psychological support in times of stress, giving us time to figure out our next financial move without losing access to essentials like:

- Food

- Utilities (water, electric, trash, oil or gas)

- Transportation

- housing

Nikki Dunn, CFP, and founder of She Talks Finance says, “people should think less about the ‘typical’ 3-6 months amount and think more about their unique situation and risk tolerance. Some people run businesses, have inconsistent income, or just feel more comfortable with more than 3 or 6 months – and that’s okay!”

Do you have health insurance?

Good health insurance policies can prevent catastrophic financial outcomes because accidents and illnesses happen. By understanding the terms of your policy, you can empower your healthcare coverage decisions, so get covered and get informed.

Do you have life insurance?

Life insurance is a risk management strategy to protect you and those you love. Many families have little to no assets to offset the loss of income.

Nikki agrees, “You don’t want your loved ones or their guardians to not have the resources to take care of themselves.”

Check out our friends over at Bestow to get covered.

Do you have disability insurance?

It’s “the most overlooked area of personal finance,” according to Jenifer Sapel of Utor Wealth. In the event you’re sick or injured, your health insurance pays your medical bills, but who will pay for your groceries, utilities, and other bills?

Overwhelmed? Hop into the Nav.It app and check out the Legacy Health Check for more guidance.

Step 4: Optimize your investments

Increase your financial resilience by optimizing your short and long term investments. While short-term investing is all about quick preservation of cash (think automating savings for a new macbook or a travel fund), long-term investing is all about growing your wealth over time.

We’ll break down your options:

Short-term Investments

High Yield Savings – some online banks offer significantly higher-yielding savings accounts than their brick-and-mortar counterparts (think: 1% interest payments as opposed to 0.01% from a big bank). As long as they’re FDIC-insured (Federal Deposit Insurance Corporation) your funds are protected.

Certificates of Deposits -Banks allow depositors to invest their cash for a specific length of time in a special deposit account called a certificate of deposit. CDs have a variety of terms ranging from three months to five years (Psst! You’ll earn a higher rate the longer you’re willing to lock up your money).

The downside to these is that once you choose a deposit term, you are required to keep your money in the account or pay a steep fee for early withdrawal—kind of like a 401(k)

Money Market accounts – based on your account balance, not the length of time you invest your money, Money Markets provide a slightly higher rate than a savings account (generally paying a rate similar to a CD). With a money market account, you’ll get an ATM card, checks, and deposit slips…but you will likely be limited in how many transactions you can make per month.

The perk? If you find a better rate elsewhere, you can transfer your money from the money market without paying a penalty for early withdrawal.

Long-Term Investments

- Sheltered Retirement Plan – We’re talking IRA, 401k, and HSAs. ALWAYS max out your retirement plans. This is a way for you to invest a percentage of income without being taxed. It means your investments can earn income and capital appreciation year over year, without immediate tax consequences.

- Stocks – Represent ownership in profit-generating organizations. They can rise over the long-term and pay dividends, but are also very liquid, enabling you to sell and buy easily, allowing for diversification and/or reinvestment. The average return on the S&P 500? 10%.

- Long-term bonds – Per Vangaurd: Unlike stocks, bonds don’t give you ownership rights. They represent a loan from the buyer (you) to the issuer of the bond. Two important things to know: they pay higher yields than short-term interest-bearing securities, and If interest rates rise, the market value of the underlying bond declines

- Mutual Funds– Considered ‘actively managed funds,’ which just means that you (or your fund manager) select specific stocks that you believe will have the best future returns.

Pros – Since it’s managed by professionals, this means someone else is in charge of all the day-to-day work of stock-picking, dividend-reinvesting (taking the cash received from [mutual funds] dividends, using it to buy more stocks or bonds in the fund) and diversifying your portfolios.

Cons – The biggest complaint about mutual funds is their fees. Creating, advertising and running a fund is expensive. Some mutual fund companies have higher fees than others. Anything above 1.2 percent is an expense fee considered on the higher cost end. - ETFs – Similar to mutual funds, they too represent a portfolio of stocks, bonds, and other investments but ETFs are considered to be passively managed, investing in an underlying index. They cost less than mutual funds, with the primary expense coming from the ETF’s broker commission.

- Real Estate – Owning a home is investing in real estate! You can also invest in Real Estate Investment Trusts (REITs) which allow you to invest in property in a similar way to stocks. Buy into the trust, and participate in the ownership and profits of the underlying real estate. It can quickly become a high yielding investment as 90 percent of their income must be returned to the investor in the form of dividends.

Step 5: Protect your legacy

We built a legacy health check into our app because estate planning is an important form of wealth transference. We get it. “Estate” is a big word but if you own something, anything, you have an estate.

So, create a will and be prepared with the right paperwork. Online companies like Trust and Will allow you to create a plan for your loved ones.

Step 6: Consider your money mindset.

You’ve taken a lot of steps to crunch numbers, but let’s check your mindset. You have the knowledge to confidently make money moves and the Nav.It Money App is equipped with all of the tools to help you do it But without the right mindset, one setback could derail your progress. Track your mindset and your financial wellness all in one place to help you withstand life events that impact your income and forge a healthy, wealthy outlook.

The nav.it money app offers you free tools for budgeting, automating savings, and tracking your expenses.

DOWNLOAD THE NAV.IT APP TODAY!

Related topics:

Do You Really Need Life Insurance?

Everything to Know about Health Insurance

The Importance of Networking During a Recession

How to Stick to Your Financial Resolutions Once and For All

Top 10 Financial Resolutions for 2023

Resolution: Financial Well-being

A Financial New Year’s Resolution: A Success Story

New Year’s Resolution Guide to Budgeting

How the Nav.it money App Helps with New Years Resolutions

20 Money Goals for the New Year