by Jasmine Powell

Rent: $1691

Utilities: $310

Personal space: Priceless.

Actually, privacy isn’t pricess. In fact, it can get stupid expensive. That’s probably why more than one-half of adults aged 18-24 live at home with their parents. The reality is that housing is expensive, and expenses associated with it (electric, water, Netflix) aren’t looking to be much cheaper anytime soon.

Despite these rising costs, moving out on your own isn’t impossible. It just takes a bit of time, effort, and smart planning.

Before you decide to start searching for apartments or homes on Zillow, here are a few things you should take care of before making that big move on your own.

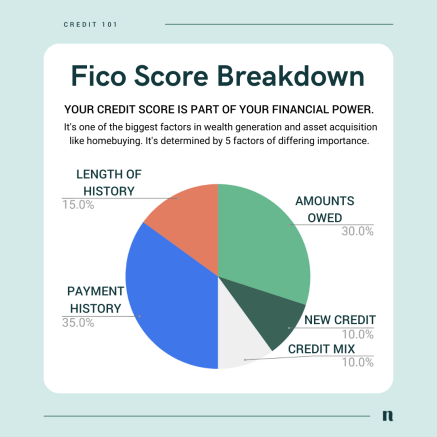

Credit Opens Your Options

Despite what you may have heard from some old school money pundits, credit isn’t your enemy. It’s a tool and can actually increase your access to different levels of housing. Make sure your credit is in tip-top shape is important in your home hunt. This is especially so if you’re looking for competitive housing markets.

For first-time home buyers, credit scores help you secure the loans for your dream home with better interest rates. For more on that, check out this article or skip straight to this video. 👇👇👇

Credit and Apartment shopping

Credit scores are important for apartment hunting because landlords and property managers use it to assess your candidacy to rent a property.

For apartments, most landlords and lenders are looking for tenants whose credit is above 600, which is a range that falls between “fair” and “good.” They are also looking at specific areas on your credit report such as payment history, rental history, and collections. (In a more competitive market, think a more competitive and HIGHER credit score.) If there are any late payments that you made in the last 24 months, anyone looking at your credit report can see it. They’ll also factor in evictions, unpaid utilities, bankruptcies and anything outstanding in collections.

Though there are landlords out there who don’t look at scores, in a competitive housing market, it’s important to have your options open.

If your credit isn’t where it needs to be right now, don’t fret! There are ways you can build your credit! Also, make sure that you check your credit report every year for any inconsistencies and help in making your credit score better.

Save, Save, Save

Having a savings account isn’t just a right of passage in adulthood: it’s a necessity. If you decide to move out into an apartment, get ready to save for your down payment.

This is on top of an emergency fund.

That’s right. We’re going there. If you’re grown enough to contemplate moving out, you’re adult enough to financially prepare for adulthood and the emergencies that come with it. (Pandemy, anyone?)

What is an emergency fund?

As Mackenzie Stewart explains, “It’s a savings fund for if you suddenly find yourself out of work, need an unexpected car repair, or need to take a kid to urgent care for a bug bite. It’s money saved that covers the unexpected so you aren’t relying on money from your checks that need to go to expenses and you’re not using credit cards.”

Nearly 25% of Americans have no emergency savings, which is scary. But understandable, as low-income households have a harder time saving money.

As Mackenzie explains, “The hardest part about saving money is saving money. Real talk. When you have a salary that barely covers your monthly expenses, the idea of putting something aside for later is either bananas or just not possible.”

So start with the emergency fund, practice not touching the money, then dive into saving for a down payment on an apartment. There is a multitude of ways you can start saving today.

Before moving out, look at how much income you’re earning

How much do you have coming in? Add up your wages along with any stipends (like an internship for example) or supplementary allotments like alimony, child support, disability, etc. Is it enough to cover all of your expenses?

If you plan on moving out

The first thing you can do is, of course, spend less than you earn! Having more money being spent than earned can put you in a real pickle. Be mindful of your spending and find ways where you can steadily grow your income.

There are big (and small) ways where you can earn more money for yourself. For me, the best way to save money while buying the things that I want is by earning more money. The first step to your savings journey maybe finding a side hustle. The opportunity for you to earn money in new ways is limited only by your creativity and time.

Set a Goal

Set a goal for the amount of money you want to save.

Make sure your goal includes a deadline.

Come up with a timeline of what you’ll have to save each month. If your housing down payment is $2000, how much will you put in your savings monthly? Will it be less or more depending on how soon you want to move? Remember all of these factors are part of setting a S.M.A.R.T financial goal. Too unrealistic, you may get discouraged and quit. Not aggressive enough and you could be selling yourself short.

Need a hand at finding the right timing? Create an Auto-Save with the Nav.it Money app to automate your saving in an FDIC insured savings account.

Before moving out, work on your relationship with money

Your relationship with money is the way you interact with money on a daily basis. It includes your attitudes and beliefs about money, as well as your behaviors when it comes to spending, saving, and investing.

Developing Better Money Habits

It’s impossible to save if you’re spending everything you make. That’s why you should work on improving your money habits BEFORE you make the leap out of the nest.

Track your spending before moving out on your own

One of the first steps to creating better money habits is tracking your spending. This will help you recognize which areas your money goes to, and help you become proactive in finding ways to reduce this spending.

How I improved my money habits

In January 2021, I began tracking what I spent each month. It all started as an assignment from my Money Coach: identify the top things/services I purchased monthly. After finding what those three were, I had to reduce my spending in those areas. My top three were Rideshare apps, food services like DoorDash, and minor products I found at work. Through this practice, I became aware of my impulsive spending.

To combat impulse spending, I would ask myself:

- How will this benefit me long-term?

- Can I find a better deal elsewhere?

- Is this something that I need?

- Will this only satisfy me momentarily?

I found myself putting back unnecessary items. Through expense tracking, I became more mindful of my spending.

Using a money tracking app to improve spending habits

An easy way to track expenses across multiple accounts is utilizing Nav.it’s Money tab. I reflect and review my transactions by swiping right for positive, left for negative and up for neutral. Building better habits requires you to engage with that habit and have a good time doing it! I learned that building a better financial situation should make you feel good about yourself, not anxious.

Create a plan for your money before moving out

This is what most people call a budget, but I’ve noticed that intimidates a lot of people. Instead, focus on creating a plan for your money. You have a ton of options to choose from.

You can do zero-based or divide your budget into a needs/wants plan, like Mackenzie.

Following the 50/20/30 budget rule is another great way to develop great habits! With this rule, you spend 50% on your needs such as rent/mortgage, groceries, and healthcare. With the 30%, you spend it on the things that you want. This would include things like Netflix, takeout, and Amazon purchases. The rest of that, the 20%, would go into your savings account. This method is a great way to continuously save money while also getting the things that you want.

Estimate your cost of living after moving out

Before moving anywhere, consider cost of living. Location impacts how expensive things are which is why factoring in location is important. NerdWallet has a really cool cost of living calculator, but you may need to dive into more research based on your region.

Paying utilities

Your utilities will not only vary by location but also whether they are included in the rent or not. The average monthly energy bill is around $112, and this number can depend on where you live and how much energy you consume. Depending on who you’re renting from, they may take care of a portion of rent on utilities such as gas, internet/cable, water, sewage and garbage.

Ways to lower your cost of living when you move out

Consider getting a roommate (if that is allowed) to lower your cost of rent. If you’re up to it, house-hacking may something you can look into as you can benefit financially and socially from it! You can estimate how much you need to set aside for utilities each month by simply asking your landlord or a fellow tenant about typical costs.

Practice Paying

Before you move out, you can practice “paying rent” for a few months, which is essentially paying your savings account the amount you would have to if you move out. This will not only prepare you to handle expenses on your own but will help your savings account as well.

Steps to take before moving out

Choose Where You Want to Live

One of the most important steps in moving out on your own is choosing where you want to live. What are some things that you like and don’t like about an area? Maybe you like areas with lots of sunlight – or maybe you enjoy more rainy weather. Are you feeling the countryside, or the city-life? Touristy areas or no? Wherever you move, you want to make sure it’s somewhere you can call home.

At this point in your plan, researching the area and doing some traveling in town or city will help you. Things that you should look for are how close it is to major cities and if you’re near any amenities. You should also look at your work commute along with how long it would take you to get to medical appointments.

Money is a factor

Make sure that you’re keeping your budget in mind when choosing where you want to live. Down payments and deposits as well as furniture should be included within that budget. Also, the recurring rent or mortgages and utilities should be taken into account.

Once you’ve chosen where you want to live and the place, ask questions! Check the cupboards, the water pressure, and anything else that’s possible! Make sure you know what you’re getting into. Most of all, don’t sign a lease on something you can’t afford.

Moving Out on Your Own Takes Time.

This can all seem overwhelming for those thinking of stepping out on their own. And it is in many ways. However, with patience and consistent saving and budgeting, you can have a place of your own that you’re comfortable with.

Related Reads

Ask the Money Coach: Losing it While Living at Home

Jasmine Powell is currently a graduate student at the University of Memphis and a freelance writer at Nav.it. Her goal is to make writing her living and create material that will help people of color in their daily lives.